Are you prepared for retirement? Are you or someone you know positioned for eventual retirement? Consider your options carefully.

Relying on pension plans, like the 401(k) can be risky—they might not be there when you need them. Many things could go wrong with your pension plan, assuming you even have one. It’s essential that you take control of your financial future.

Market investments are volatile with inherent risks. Think of 2008, when the market plummeted by more than 47%? Most investors lost half of their nest eggs.

Real Estate investments bring challenges like dealing with difficult tenants or buying property at the wrong time in the market cycle.

Social Security? Will it even be available when you need it?….let’s hope. Realistically, how much of your financial needs will Social Security cover?

Did you know that once you take control of your 401(k) you can transfer the funds into this program, while staying behind the IRA wall and continuing to defer taxes until retirement.

Secure your financial future with predictable annual retirement income through high-yield annuities offered by The Life Insurance Safe Zone. Set it in motion and forget about it until it’s time to begin withdrawals. These annuities can be funded:

- As a lump sum

- Monthly deposits

- Combination of the above 2 methods

These High-Yield Annuities offer the following Facts, Pros & Cons

Facts:

- No fees or costs

- Investments must be held for at least 10 years.

- The minimum investment required is $20,000.

- No maximum investment limit.

- Future projections are based on the past 10 years of actual performance.

Pros:

- No fees or costs

- Unlimited, uncapped, upward potential, allowing you to benefit from market gains.

- Guaranteed protection against market declines. This applies to both the principal and the gain.

- Taxes are deferred until payout.

- You don’t have to decide when the payouts begin, how long the payouts will be for (how many years they will last) the frequency of the payouts (monthly or annually), or how much the payouts are until you actually want them to begin.

Cons:

- Early withdrawals (before maturity) exceeding 10% of the market value are subject to declining penalties.

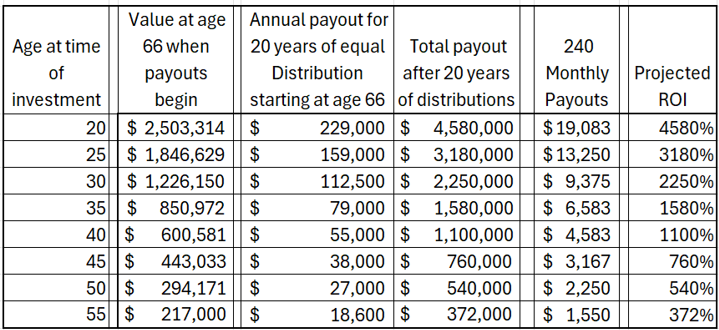

Example based on the value at age 65 of Investing $100,000 in this program at the following ages:

The above projected payouts are based on a future growth to be like the index growth over the past 10 years. The actual index growth could be higher or lower than the projection.