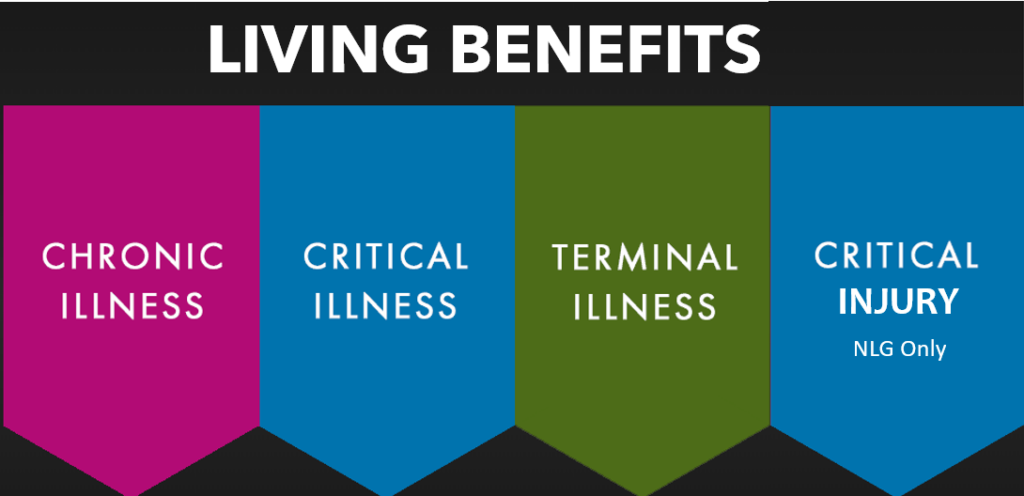

An advance cash payment of a portion of the insurance before the insured person dies. It allows for financial assistance to the insured individual while he or she is still alive. Not all policies will cover all 4 categories. There are 4 typical categories of Living Benefits:

Terminal Illness

An insured has a terminal illness if they have been diagnosed and are suffering from a terminal illness that will result in death within 24 months (typically) with certification of the terminal illness by a physician.

Critical Illness

An insured qualifies under the Critical Illness for: • Diagnosis of ALS (Lou Gehrig’s disease) • Blindness • Diagnosed with cancer • Diagnosis of End-stage renal failure (kidney failure) • Heart attack • Major organ transplant • Stroke

Critical Injury

An insured qualifies under the Critical Injury rider for: • Coma • Paralysis • Severe burns • Traumatic brain injury. The vast majority of carriers do not cover critical injury. The only one that I have found that covers critical injury is National Life Group

Chronic Illness

Being chronically ill means you’re unable to perform at least two of the Six Activities of Daily Living (eating, bathing, getting dressed, toileting, transferring, continence)

Are You A Candidate for Privatized Banking?