A simple yet complete explanation of life settlements

A life settlement is a financial transaction where a life insurance policyholder sells their existing policy to a third-party investor for a lump sum cash payment. This transaction offers policyholders an alternative to surrendering or allowing their policy to lapse.

Key Features of Life Settlements

Parties Involved:

- The policyholder (seller)

- The third-party investor (buyer)

- Life Settlement Agent (facilitator)

Financial Aspects:

- The cash payment is more than the policy’s surrender value but less than the death benefit

- The seller receives immediate funds

- The buyer assumes responsibility for future premium payments

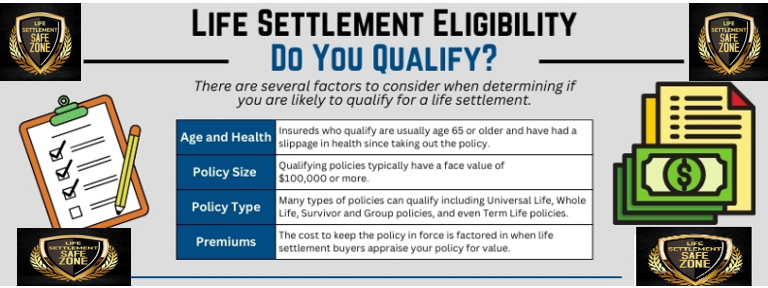

Types of Policies That Qualify

- Any Permanent (Cash Value) Policy

- Term Policy that can be converted

Ownership Transfer:

- The buyer becomes the new beneficiary of the policy

- The buyer receives the full death benefit when the insured person passes away

Reasons for Choosing a Life Settlement

Policyholders may opt for a life settlement due to various circumstances:

- Inability to afford ongoing premiums

- No longer needing the policy

- Funding long-term care or medical expenses

- Addressing other financial needs

Eligibility

Life settlements typically involve:

- Policyholders aged 65 or older

- Life insurance policies worth $100,000 or more

Types of Life Settlements

- Traditional: The entire policy is sold for a cash lump sum

- Retained Benefit: The seller retains a portion of the death benefit while eliminating premium payments

- Viatical Settlement: A specific type for terminally ill policyholders with a life expectancy under two years

Life settlements provide a way for policyholders to unlock the value of their life insurance policies during their lifetime, offering financial flexibility when circumstances change.