As a business owner, losing a “key person”—such as a partner, top executive, or any other critical individual—can be catastrophic to the business. It could prove to be nearly impossible to replace them without serious financial consequences to the business.

That’s why it’s important to consider key person life insurance (aka “Key Man/Woman Life Insurance”) if you own a business that relies on more than just yourself, to keep it operational and profitable.

Benefits to the Employer:

ATTRACT, RETAIN, PROTECT, SUSTAIN

- Attraction – You make yourself more attractive to the candidate, by offering unequaled retirement benefits.

- Retention – Retain the employee through the same retirement package that attracted him/her, that grows year-on-year.

- Protection – Protect the company from the employee’s premature death with a substantial life insurance payout.

- Sustainability – Banks feel more secure in lending money knowing that the company is financially protected from the potential of a key person’s early demise.

(See an example at the bottom of this page.)

What Is the Purpose of Key Person Life Insurance?

Key person insurance is designed to pay a life insurance death benefit to a business rather than individual beneficiaries if the insured person dies. Also, the policy can be structured to pay multiple beneficiaries including both the business and the insured’s family.

Every small and medium business should have a contingency plan for worst-case scenarios. The plan should include what to do if a crucial member of the business dies. Fortunately, tools are available to help business owners navigate this exact scenario, including key person insurance. You may hear “key person insurance” called “key man insurance” or “key woman insurance.”

The business typically pays the premiums on this type of life insurance policy and is the primary beneficiary.

What is a key person?

The “key person” named on the policy is someone who is considered essential to running the business, whether it’s an owner/partner, top executive or someone with specialized knowledge and skills. Losing this person would cause the business to suffer financially, as it would be difficult and/or expensive to replace them, or because they bring in a significant amount of revenue.

Who Needs Key Person Insurance?

If you run a business by yourself, you probably don’t need key person life insurance. But if you have a business partner(s) or a certain employee(s) who is invaluable to the company, it’s a good idea to be insured. In fact, some commercial lenders may even require key person life insurance for key people within the organization, so it’s something to consider if you’re looking to expand your business with a loan.

Beyond protection, it is a source of tax-free passive income.

What Does Key Person Insurance Cover?

Key person insurance provides a death benefit to a business so that it can continue operating if a key person dies. There are no restrictions on how the death benefit is spent, and it is tax-free. The funds can be used for any expense, including daily operational costs, training a new hire, or paying off debt.

In some cases, closing down the business is the best course of action, in which case the death benefit can help ease the transition by covering costs such as paying out severance to employees, distributing funds to investors, paying off creditors and more.

In addition to a death payout, key person life insurance policies come with benefits you can leverage while the insured is alive, like the Infinite Banking concept, for example. You may be able to borrow against the value of the policy or withdraw cash (which would reduce the death benefit if not paid back).

Another benefit would be if the insured were to become Critically ill and unable to perform his/her duties you could affect the policy’s “Accelerated Death Benefits”.

Finally, the policy, if constructed correctly, can provide a tax-free passive income stream for the key person. This would be subject to the insured’s age and health at the time the policy is first taken.

Key Person Insurance Policy Types

Similar to individual life insurance policies, key person life insurance falls into two main types: term and permanent.

Key person term life insurance

Term life insurance is designed to cover the insured for a specific time period (the term)—usually 10 to 30 years.

This type of coverage tends to be more affordable than permanent life insurance, though it is also more bare-bones in terms of policy features. Once the term is up, if the policy isn’t renewed, it expires with no death benefit payment. If you renew the policy, expect a much higher premium.

A term life policy can also sometimes be converted to a permanent life insurance policy, depending on the insurance company and the policy.

Key person permanent life insurance

As the name suggests, permanent life insurance generally does not expire as long as the premiums are paid. It covers the insured for a lifetime and may provide benefits you can access while they’re still living. For instance, permanent life insurance accumulates cash value, which can be accessed for business needs. The growth rate and investment options for the cash value depend on the type of policy, such as whole life, universal life or variable life insurance.

The key difference between a whole life and an IUL (Indexed Universal Life) is that whole life has a guaranteed growth rate, while an IUL is tied to a market index and can dramatically fluctuate from one year to the next. However, over an extended amount of time, the IUL will have a gain that is significantly higher than the whole life. The IULs used by the Life Insurance Safe Zone will never go below a 0% gain no matter how badly the market performed that year, guaranteed.

Key Person Insurance Riders

Both term life and permanent life insurance often offer a disability coverage rider. After all, your business may be impacted whether a key person dies or becomes severely disabled.

A key person disability income rider on a life insurance policy generally pays 40% to 70% of the disabled employee’s earned income.

There may be other riders available depending on the insurance company and specific type of policy.

Key Person Employee Retirement Benefits

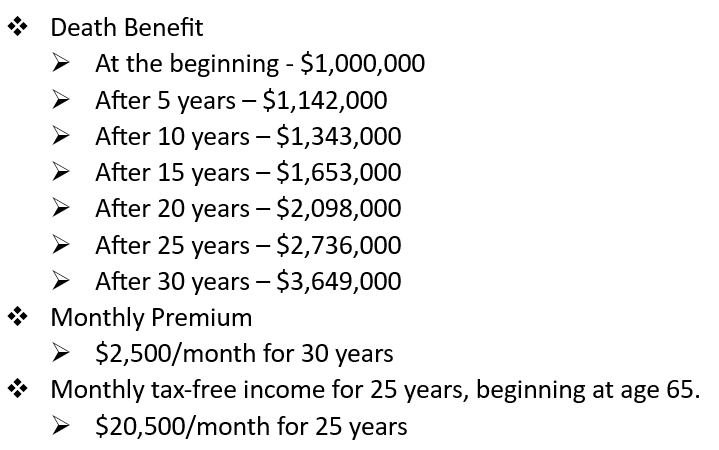

Dependent on the employee’s age and health, a cash-value life insurance policy can be taken out on that employee and paid for by the employer. This makes the employee the “insured” and the employer the “policy owner” and the primary beneficiary. The typical death benefit for this type of policy is $1,000,000 at the beginning of the policy. The policy can actually be taken out for less or more than the $1,000,000. The employee can contribute to the policy premium to the tune of how much death benefit does he/she want their family to get as opposed to how much the employer gets. This can be a part of the $1,000,000 or in addition to the $1,000,000.

Upon the successful completion of XX number of years of service to the company, the ownership of the policy can be transferred to the employee as a tax-free retirement package. This makes the employee the recipient of a tax-free income stream. A separate agreement between the “Key Person” and the Employer detailing the conditions under which the transfer was to take place needs to be in place in order to protect the rights of each.

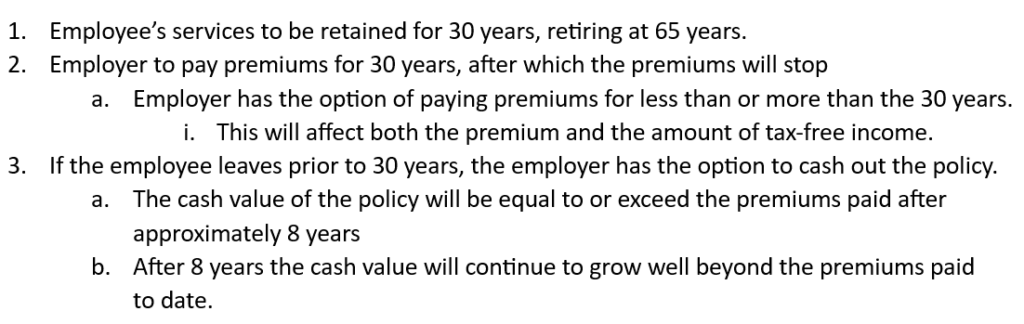

Example: This example is based on a healthy 35-year-old male who is critical to the success of the business. This policy encompasses the following, all of which can be modified based on the employer’s and employee’s desires, understanding, and current circumstances:

All of the above is subject to the specifics of the employer’s/employee’s unique circumstances.

This concept can apply to corporate officers, business partners, or any individual who is critical to the continued and successful operations of the business.

In addition, this policy comes with a set of Living Benefits which includes a long-term care rider at no additional fees.

Please contact the Life Insurance Safe Zone to work up the policy specifics that will be based on your unique requirements.